sacramento property tax rate 2021

What is the sales tax rate in Sacramento California. They can be reached Monday - Thursday 830 am.

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Sacramento county collects on average 068 of a propertys assessed fair market value as property tax.

. Automated Secured Property Information Telephone Line. Unsure Of The Value Of Your Property. The Sacramento sales tax rate is.

The estimated 2022 sales tax rate for 95828 is 775. The minimum combined 2022 sales tax rate for Sacramento California is. Has impacted many state nexus laws and sales tax collection requirements.

This tax has existed since 1978. If you owned unsecured property in Sacramento County such as a boat or aircraft or if you leased or owned fixtures and equipment related to a business on Jan. Property Tax Administrative Fees - SB 2557.

The California sales tax rate is currently. The minimum combined 2022 sales tax rate for Sacramento County California is 775. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

This is the total of state county and city sales tax rates. Permits and Taxes facilitates the collection of this fee. The Sacramento property tax rate is on average 068 of the propertys appraised value.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. Fiscal Year 2015-2016. Sacramento county tax rate area reference by taxing entity.

1 2021 and do not receive a tax bill by Aug. Start filing your tax return now. Ad Get Record Information From 2021 About Any County Property.

What is the sales tax rate for the 95828 ZIP Code. For more information view the Parcel Viewer page. 31 2021 additional collection costs and monthly penalties at the rate of 15 percent will be added to the base tax.

Paying Your Property Tax The Sacramento County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. Available 24 Hours a day 7 days a week 916 874-6622. 3636 American River Drive Suite 200 M ap.

Ultimate Sacramento Real Property Tax Guide for 2021. The California state sales tax rate is currently 6. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

7 2021 please contact the Sacramento County Ta x Collectors Unsecured Property Tax Unit at 916 874-7833 between the hours of 9 am. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and county sales tax rates.

View the E-Prop-Tax page for more information. The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021. Sacramento Property Tax Rate While California is known for its high taxes the state usually has lower-than-average property taxes.

2020 Business Pr o perty Statement 571-L-2019. Tax Collection and Licensing. The Sacramento County sales tax rate is 025.

Actually tax rates cant be hiked before the general public is first apprised of that aim. Did South Dakota v. Median Property Tax Rates By State Ranked highest to lowest by median property tax as percentage of home value 1 1 New Jersey 189 2 New Hampshire 186 3 Texas 181 4.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The 2018 United States Supreme Court decision in South Dakota v. The Sacramento sales tax rate is 1.

That includes the state county and city sales taxes. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Each TRA is assigned a six-digit numeric identifier referred to as a TRA number.

Aircraft Property Statement 576-D Vessel Prope rty Statement VOR Vessel Owners Report 571-J Annual Racehorse Tax Return. 2021-22 1036 104 101036 1 Increase to base year value is limited to 2 percent pursuant to California Constitution article XIII A section 2b. This is the total of state county and city sales tax rates.

Property information and maps are available for review using the Parcel Viewer Application. Voter Approved Bond Debt Rates. Its also home to the state capital of California.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. The County sales tax rate is. All are public governing bodies managed by elected or appointed officers.

To review these changes visit our state-by-state guide. Start filing your tax return now. When calling the Tax Collectors Office your call is answered by our automated information system.

Sales tax in Sacramento is 875. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. Effective tax rate Sacramento County 00081 of Asessed Home Value California 00076 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Sacramento County 2862 California 3818 National 2471 Median home value Sacramento County 351900 California 505000 National 217500 Median income.

In setting its tax rate Sacramento is compelled to adhere to the Pennsylvania Constitution. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. TAX DAY NOW MAY 17th - There are -360 days left until taxes are due.

Sacramento County Finance. Find All The Record Information You Need Here. Tax Rate Areas Sacramento County 2021 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. TAX DAY NOW MAY 17th - There are -382 days left until taxes are due. 2022 Depreciation Tables Depreciatio n Tables 571-L-2021 2021 Busines s Property Statement 571-L-2020.

Sacramento County Ca Property Tax Search And Records Propertyshark

California Mortgage Calculator Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Sacramento County Sales Tax Rates Calculator

Property Tax Calculator Casaplorer

Sacramento County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Sacramento County Ca Property Tax Search And Records Propertyshark

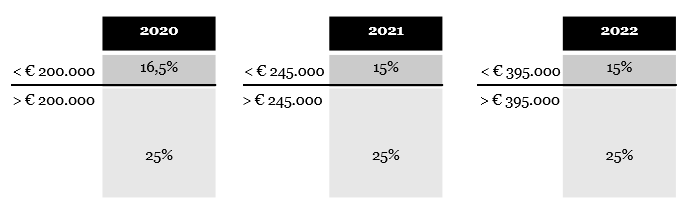

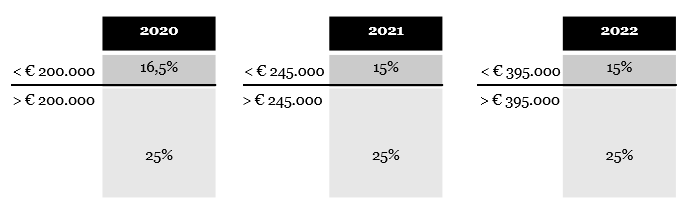

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Sacramento County Property Tax Anderson Business Advisors

Secured Property Taxes Treasurer Tax Collector

Sacramento County Transfer Tax Who Pays What

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Secured Property Taxes Treasurer Tax Collector